Top 5+ Best Business Credit Builder Programs And Services

A business credit builder is a product or service that helps small business owners establish and build their business credit.

This is especially great for start-up businesses that are starting from zero and need to build business credit fast in order to obtain capital to build their company.

There are many different types of products available, each with its unique benefits. Some of the most common business credit builders include secured credit cards, lines of credit, and loans.

A business using a business credit builder can demonstrate to lenders that they are responsible and reliable borrowers.

In this article, we will look at some of the top business credit builder programs that can assist you in building your business credit, each having its unique way of doing so.

What Are The Best Business Credit Builder Programs?

When starting a new business, it is important to establish a good business credit profile from the beginning. A business credit builder can help small business owners do just that.

The best business credit builders are those that provide detailed credit reports and score tracking. They also offer educational resources to help business owners understand their business credit file and how to improve it.

When choosing a business credit builder, be sure to consider the cost, features, financing options, and customer service.

The following are some of the top credit builder programs and services that can fast-track your business credit building and get you access to business capital.

Credit Suite

Overview

Credit Suite is a business credit builder service that helps small businesses to establish and build business credit. This can help businesses to get loans, lines of credit, and other types of financing they may need in order to grow their business.

Credit Suite offers a wide range of services and tools to help businesses succeed in establishing good credit which includes credit monitoring, credit analysis, and credit education. This allows small businesses to have a one-stop shop for all their business credit-building needs.

Top Features

- Business Credit Building and Funding Combined.

- Business Credit Report Monitoring – Gives you access to watch your business credit progress.

- Business Finance Suite, Online Platform – Offers a step-by-step walkthrough to build your business credit from start to finish.

- Live Expert Team Support – Customer service to support your questions and give you direction when needed.

- The Largest Supply of Vendors and Credit Issuers.

- Get A D-U-N-S Number and Your Phone Number Listed With 411 For FREE.

Pricing

Credit Suite’s pricing is $2997 for a single payment, giving you a 30% discount, or $597/month for 7 months for a total of $4179.

Bottom Line

Credit Suite’s credit building program offers the small business owner a way to demystify how to build business credit by guiding you through a clear step-by-step process that saves you time and gets capital funding into your hands as soon as possible.

If you are just starting your business or you are just now starting your journey to build business credit and you can’t afford the time to figure it out on your own, then Credit Suite would be a great choice to get the job done.

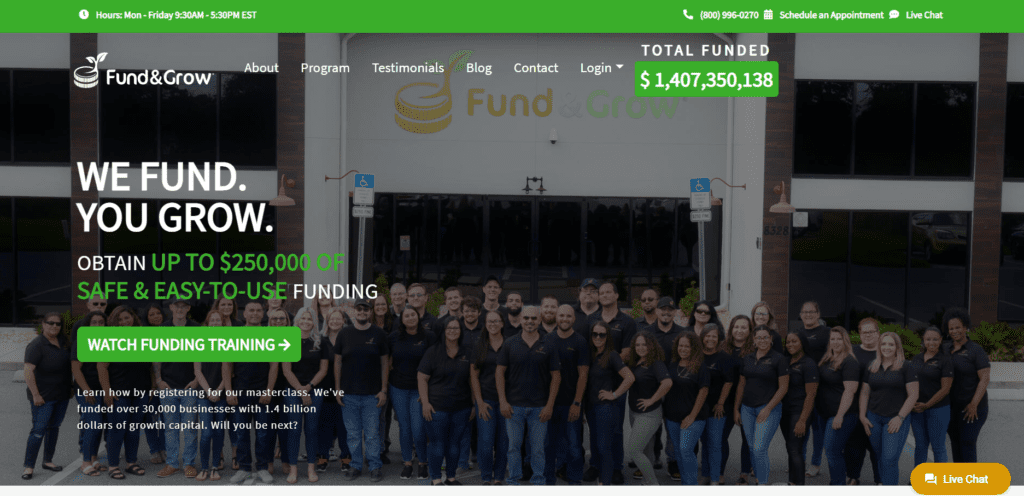

Fund & Grow

Overview

Fund & Grow has been in business since 2007 and offers entrepreneurs and business owners the ability to access business credit lines through their Fund & Grow membership program.

Their goal is to help small business owners who are struggling with raising capital, to do so with unsecured business credit that does not appear on your personal credit but appears on your business credit bureau.

Top Features

- Obtain Up To $250,000 In Unsecured Business Credit.

- Risk-Free 60-Day Money Back Guarantee.

- One-On-One Unlimited Coaching and Credit Building.

- Perfect For Business Start-Ups.

- Works With Real Estate Investors.

- Access Up To $100,000 In Vender Corporate Credit With No Personal Guarantee.

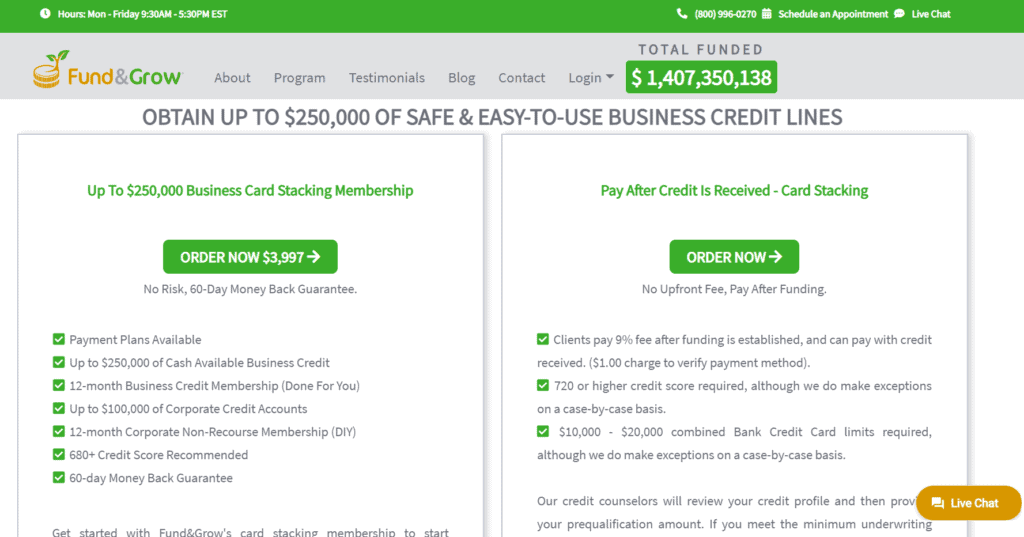

Pricing

Fund & Grow charges a one-time payment of $3997 for membership services. They do offer payment plans.

Bottom Line

Fund & Grow offers a streamlined way to secure capital for your business while building business credit at the same time.

If you are seeking a way for you to get access to capital fast in order to build or expand your business, then give Fund & Grow a try!

NAV

Overview

NAV is a company that uses technology to match business credit profiles with the best lender opportunities based on NAV’s MatchFactor. MatchFactor is a technology giving businesses a 3.5 times greater chance of getting approved for business financing.

NAV also offers its own credit builder for businesses that reports to 3 business credit bureaus providing businesses a tradeline to build their business credit profile. Their service also includes business credit monitoring so you know where your business credit scores are every step of the way.

Top Features

- NAV’s Business Boost & Business Loan Builder – Credit builders offered by NAV reporting to major commercial credit bureaus.

- No Negative History Reported – NAV will never report a negative history to your business credit reports.

- Dedicated Funding Manager – Helping you to get the best rates and terms on business loans or business lines.

- Free NAV Account – Get access to 24/7 alerts when something changes on your business credit history.

- Full Business Credit Reports And Scores – Reports from Dun & Bradstreet PAYDEX, Experian Business, and Equifax Business.

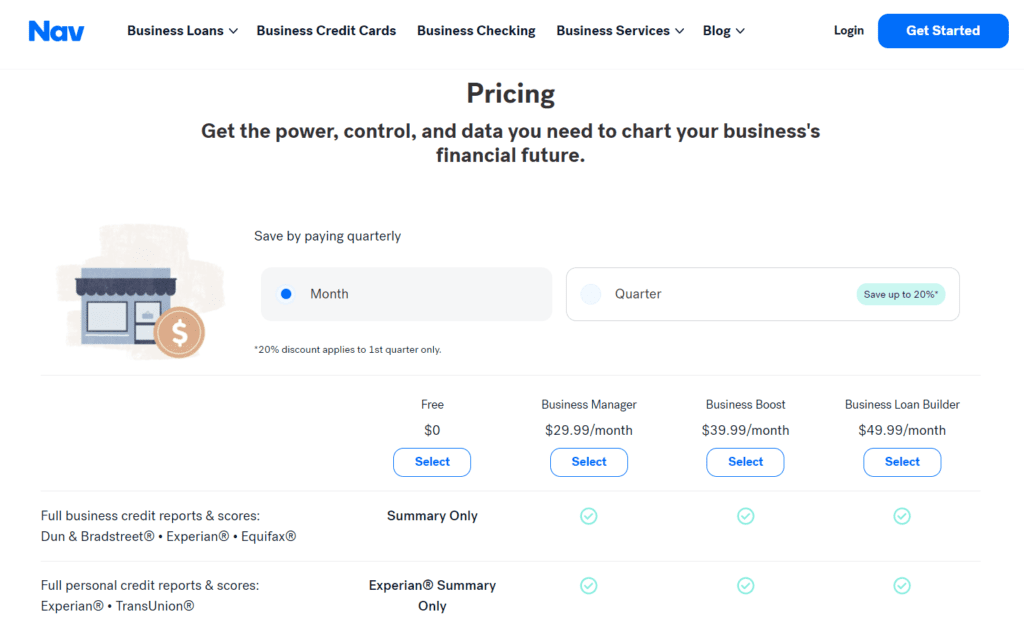

Pricing

NAV’s pricing ranges from $29.99/month to $49.99/month, depending on the plan you choose. They do offer a 20% discount if you pay quarterly.

Bottom Line

NAV offers powerful tools to build business credit. Their business credit monitoring and credit builder for businesses allow the business owner to establish business credit that will open the door to access more lenders for business capital.

If you are wanting a do-it-yourself way to build business credit and qualify for credit lines and business loans, then NAV can help you succeed by providing you with the tools.

Divvy

Overview

Divvy is a company that provides an easy path to building business credit. They offer their Divvy Credit Builder program which gives business owners with no business credit score a way to build their business credit and work their way up to an unsecured credit line.

Top Features

- Reports To 2 Business Credit Bureaus – Dun & Bradstreet and SBFE.

- The Divvy Platform Is Free.

- Credit Lines Up To 15 Million.

- Flexible Rewards – The more you make payments, the more rewards you can earn.

- No Minimum Balance Required – Pre-fund your account with any amount.

Pricing

Using Divvy is free – There are no annual fees, no monthly fees, no initiation fees, and no hidden fees.

Bottom Line

The Divvy Credit Builder Program is an easy way for any startup business or business with no business credit score to build a payment history. Does Divvy report to Dun and Bradstreet? Yes, and that is a plus!

They provide a way that you can start with a secured credit line and work your way up to an unsecured credit line as you build your business credit profile.

If you need a credit line that can grow with your business, then Divvy is a smart choice to add to your business credit-building profile.

TillFul

Overview

Tillful is a company aimed at helping small business owners access capital early on and build credit in the process. Their proprietary credit scoring model uses artificial intelligence and machine learning to score businesses with an alternative method to gauge the financial health of the business.

Tillful offers a way for businesses to build business credit rapidly through their secured credit line product.

Top Features

- Secured Business Credit Card.

- No Personal Guarantee For Approval.

- 0% APR & No Annual Fee.

- Reports To Experian and other major credit reporting agencies.

- Free Business Credit App – Track your business credit score with the Tillful App on iPhone or Online.

Pricing

Using the Tillful Card is Free.

Bottom Line

Tillful is a way for new business owners and businesses yet to build a business credit history to streamline the process and gain access to business capital.

If you are a business just starting out and are looking to build your business’s tradelines and grow your business credit score, utilizing the Tillful Card is a tool you will want to add to your Business.

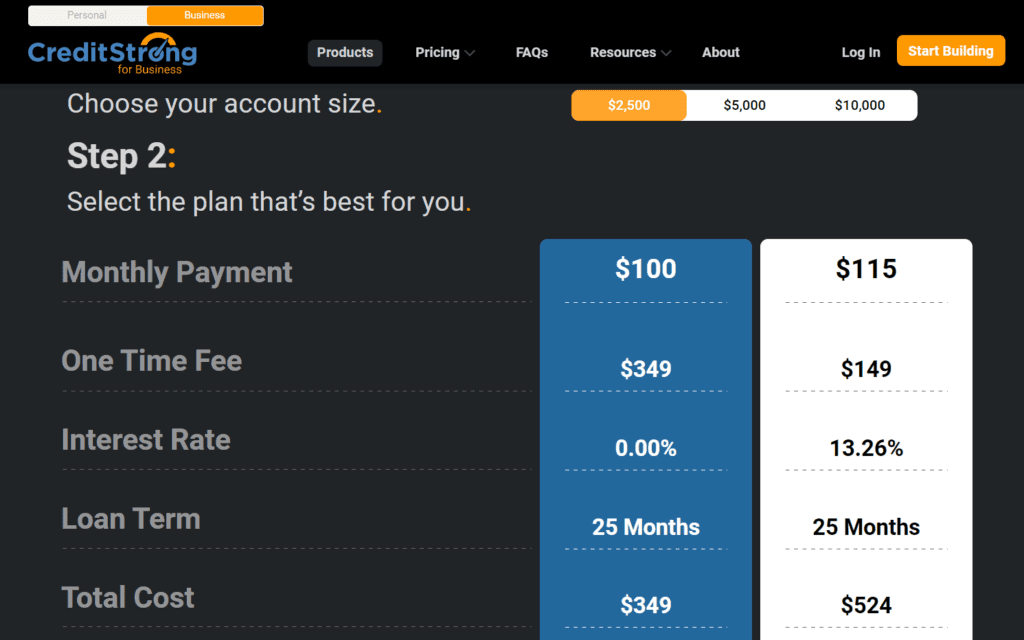

Overview

Strong Credit is a company that provides credit-building services to businesses by offering a business loan. They provide a way for businesses to build a payment history by making on-time payments on a locked installment loan.

Strong Credit gives companies a chance to build a good business credit score without the need for personal credit by using the business’s EIN.

Top Features

- Up To $10,000 Business Installment Loan.

- No Personal Credit Check.

- Reports To Major Business Credit Bureaus – Equifax, PayNet, and SBFE.

- Reported As A Financial Tradeline – Not a vendor account.

- No Fee For Canceling Or Closing Account Early.

Pricing

Credit Strong’s one-time fee ranges from $349 – $1299, depending on the account size you choose. And then the monthly payments, which contribute toward your business savings account, range from $100/month – $440/month.

Bottom Line

Credit Strong offers a credit builder program for businesses that builds credit and saves money at the same time. Having a financial tradeline on your business credit profile is important to building strong business credit.

If you are missing this type of tradeline for your business, then Credit Strong is an opportunity you can take advantage of to establish and grow your business credit score.

What Is A Business Credit Builder?

A credit builder is a service that helps small businesses improve their credit score. This can be done by reporting the business’s monthly payment history to the three major business credit bureaus.

A higher credit score can lead to better interest rates and terms when borrowing money, and can also make it easier to get approved for business credit cards and other lines of credit.

Also, a business credit builder can help businesses track their spending and keep their finances organized, which will help them build a positive credit history.

Conclusion

Strong credit history is important for any business, and a business credit builder can help streamline the process. It can help you secure loans, lines of credit, and access financing when you need it most.

Using a business credit builder can also make the process much easier and less time-consuming. By establishing good credit early on, your company can enjoy a number of benefits down the road.

So whether you are just starting your business or you are looking for ways to build business credit, utilizing a credit builder for your business can get you to your business credit goals faster.