Top 5 Best ACH Payment Processing For Small Business

When starting a small business, it is important to choose the right payment processing system. There are many different options available, but not all of them are the best for small businesses.

In this article, we will discuss ACH payment processing and why it may be the best option for your small business.

We will also list five of the best ACH payment processing companies in 2022 and explain why they are the best choices for small businesses.

What Is The Best ACH Payment Processing For Small Business?

It is essential to know what the best ACH payment processing options are for a business. Trying to decide on the best ACH payment processor for small businesses can be tough.

There are a lot of different options out there, and it can be hard to know which one is right for your business.

ACH payments are a great payment option for businesses of all sizes, as they are quick, convenient, and secure.

When you’re looking for a payment processor, you’ll want to make sure that they offer ACH payments. You’ll also want to consider things like processing costs, fees, and ease of use.

The bottom line is that you’ll want to find an ACH processor that offers the best combination of features and cost for your business needs.

With a little bit of investigation, you should be able to find the perfect ACH payment processor for your small business.

To cut your research time, I have provided below some of the top ACH processing companies to help you move forward in your business, so you can start accepting ACH payments as soon as possible.

National Processing

Overview

National Processing is a company that provides ACH payment processing services to businesses of all sizes. They have been in business since 2007, and they are dedicated to providing the best possible payment solutions to their clients.

They offer a wide range of products and features that make it easy for businesses to process payments and manage their finances.

Top Features

- Works With Startups and Small Businesses.

- Proprietary Payment Processing Software – High-capacity payment processing and secure NSF check recovery solutions.

- Check Verification Service – protecting against fraud.

- NP/eCheck Processing – Process checks and other types of financial transactions online.

- No Long-Term Contracts or Early Termination Penalties.

- No Monthly Minimum Transactions.

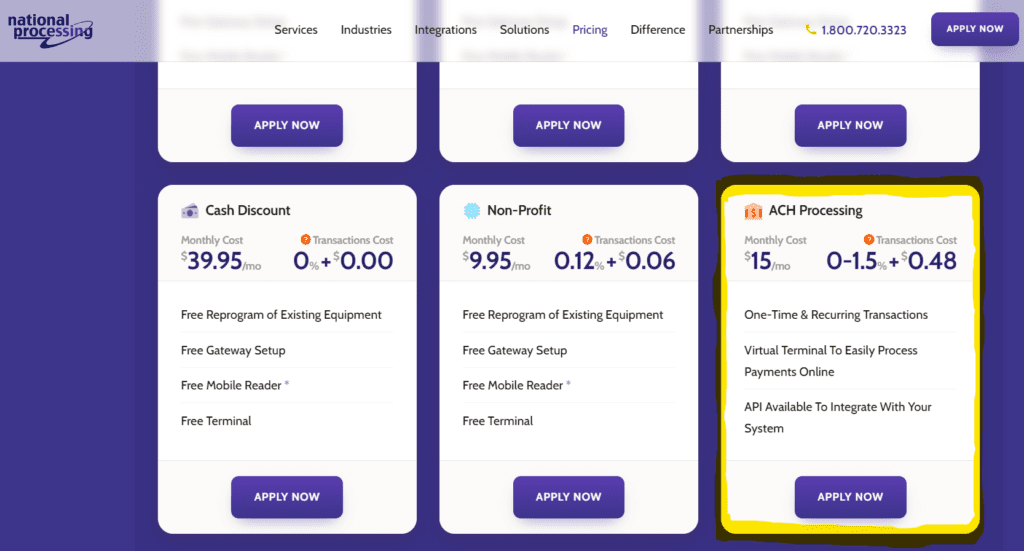

Pricing

National Processing is priced at 0-1.5% + $0.48 for ACH transactions. Also, there is a monthly cost of $15/mo. for the service.

Bottom Line

National Processing is rated as one of the top payment processors in the industry.

They like working with startups, so this is a benefit if you are just starting out and need to get set up and running as soon as possible.

They are flexible and can tailor merchant services to meet your business’s needs and budget. National Processing guarantees to beat the competition and always provide the lowest price possible.

If you are looking for a payment processing company to be budget friendly to your business needs then you should give National Processing a try.

Square

Overview

Square is a company that provides various payment processing services. They are one of the most popular merchant service providers, and they offer many features that make them a great choice for businesses of all sizes.

In addition to their merchant services for accepting credit cards and debit cards, Square also provides ACH payment services through what they call, Square Invoices.

Top Features

- Send And/Or Recieve ACH payments online.

- No Hidden Fees – There is no startup fee, monthly fee, or cancellation fee.

- Get Paid In A Timely Manner – Funds are deposited into your bank account within 3 to 5 business days.

- Can Set Up Recurring Bills.

- In-Store and Online Payment Processor.

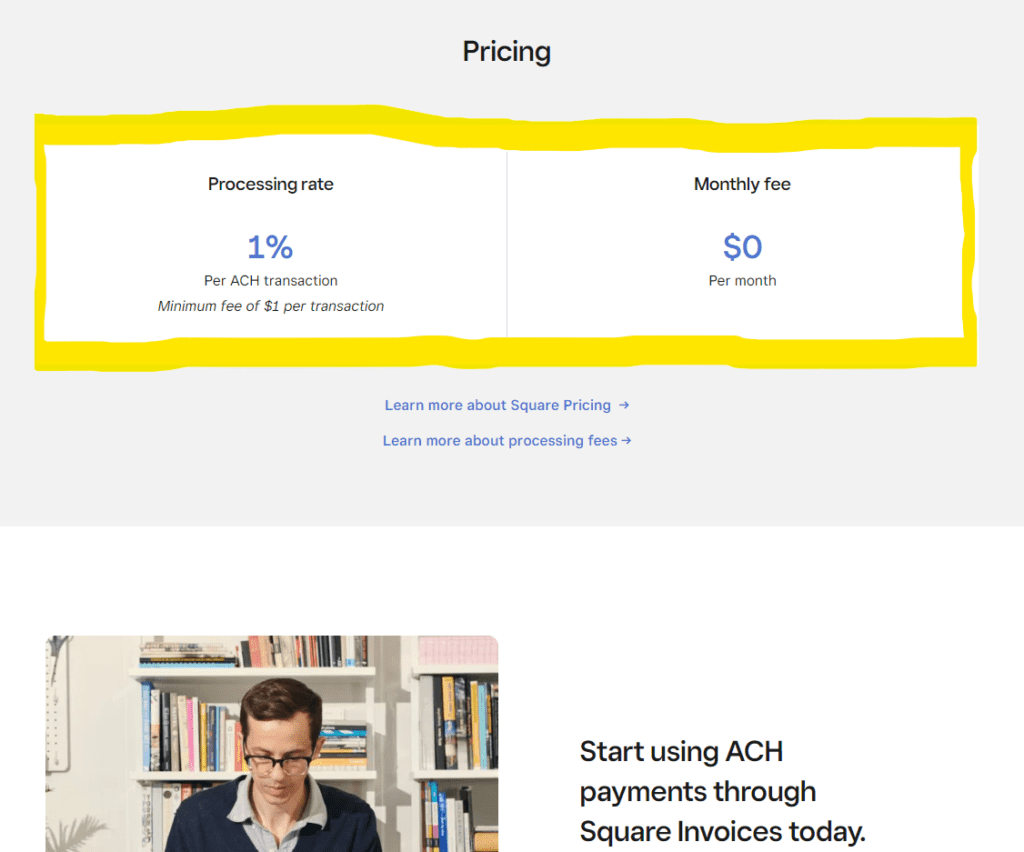

Pricing

Square charges 1% for ACH transactions with a minimum fee of $1 per transaction. There is no monthly fee for the service.

Bottom Line

Square is one of the most well-recognized payment processors for both in-store and online merchant processing needs. Their ACH processor is simple yet effective in the purpose it serves.

If you have more of a need for sending ACH payments or providing a way to accept ACH payments through invoices, then Square is a great choice for your ACH processing.

Payment Cloud

Overview

Payment Cloud is a company that provides ACH processing for small businesses. They have years of experience in this industry, and they are dedicated to providing the best possible service to their clients.

They are one of the best companies in this industry, and they offer many features that make them a great choice for businesses of all sizes.

Top Features

- Simple Application & No Setup Fees – Can get approved and set up within 48 hours.

- Accept ACH Payments From Anywhere – Accepts payments online or on a mobile phone.

- Ability to Subscribe Customers to Recurring Billing.

- Fraud Reduction Through Check Verification and Processing.

- Money Into Your Bank Account within 24 Hours.

- Customers Don’t Need To Create An Account To Pay.

Pricing

Payment Cloud doesn’t display their pricing online. Connect with them directly to get a quote for your business.

Bottom Line

Payment Cloud works with High-Risk to Low-Risk companies and they specialize in working with small businesses.

One of the biggest advantages of using Payment Cloud is their customer service. They are always available to help their clients, and they are happy to answer any questions that you may have.

They also offer a wide range of features that make it easy for you to process payments and manage your business finances.

If you are looking for a reliable ACH payment processing company, Payment Cloud is a great option.

Helcim

Overview

Helcim is a Canadian company that provides payment processing services in Canada and the United States. The company has been in business since 2006 and is headquartered in Calgary, Alberta.

Helcim offers a wide range of payment processing services through its all-in-one merchant platform, including card processing, ACH payments, and mobile payments. The company also offers a variety of POS terminals and other hardware products for in-person payment needs.

Top Features

- Available In Canada & USA

- No Contracts & No Monthly Fee

- All-In-One Merchant Platform – In-Person, online, keyed, and over-the-phone payment solutions.

- Bank Deposits within 2 Business Days

- No Bank Change Needed – You can use your own bank account!

- Recurring Billing

Pricing

Helcim charges 0.5% + $0.25 per transaction. No additional monthly fee.

Bottom Line

Helcim is an easy choice for small businesses because they offer an all-in-one merchant platform that includes the ability to process ACH payments.

They are available in Canada and the U.S. and applying for an account is easy to get set up. Customer service is available with a live person making it convenient to get your questions answered when needed.

If you need an all-in-one solution to your payment processing that includes ACH payment processing, Helcim is a great overall choice to get started with and they make it easy.

Stripe

Overview

Stripe is a technology company founded in 2010, that builds software to make it easy for businesses to accept payments over the internet.

Stripe offers a suite of payment tools that small business owners can use to accept payments from customers anywhere in the world.

With Stripe, business owners can easily create and manage invoices, set up recurring payments, and accept payments by credit card, debit card, or ACH bank transfer. Stripe also offers built-in fraud protection, PCI compliance, and 24/7 customer support.

Top Features

- Works Globally in 47 Countries

- Generate Payment Links or Use Invoicing

- Large and Recurring Payments Accepted

- Built-in Verification to prevent fraud

- Two-Day Settlement – for eligible businesses, otherwise the standard 4 business days to settle.

- Available As An Addon To Any Type Of Stripe Integration.

Pricing

Stripe charges 0.8% per ACH transaction with a cap of $5.00 for a standard settlement. 1.2% per ACH payment for a two-day settlement.

Bottom Line

Stripe has been in the payments industry for over a decade and has grown to be one of the largest providers.

They focus on helping small businesses get set up on accepting payments in the U.S. and globally in 47 countries.

If you have international clients and need a global payment processing solution, then Stripe will most likely be your best choice to try.

What Is ACH Payment Processing?

ACH (Automated Clearing House) payment processing is a type of electronic payment that allows businesses to send and receive payments via the Automated Clearing House Network.

ACH payments are typically cheaper and faster than traditional methods like checks or money orders, and they can be processed automatically, which can save time and improve cash flow.

Small businesses can benefit from ACH payments in a number of ways. First, ACH payments can help businesses save money on transaction fees.

Second, ACH payments can be processed quickly and efficiently via the ACH network, which can improve a business’s cash flow.

Third, ACH payments can be automated, which can save a business time and money.

Ultimately, ACH payment processing can provide several advantages for small businesses.

Conclusion

When it comes to the best ACH payment processing, there are a lot of great options available for small businesses. Each of the companies I’ve mentioned has its own unique set of features and benefits that make them stand out from the competition.

So, which one is right for you? Well, that depends on your specific needs and what you’re looking for in a payment processing solution.

No matter which company you choose, make sure to read the terms and conditions carefully so you know exactly what you’re getting into. Payment processing can be complex, so it’s important to understand all the ins and outs before signing up.

The companies I’ve provided are some of the best choices in the industry, so whatever your need is, one of them can meet your payment processing needs and get you moving forward in your business.